This indicate that the investor wants KLSE to go up.. and wonder who are the main investors who are helping to maintain this index price :)

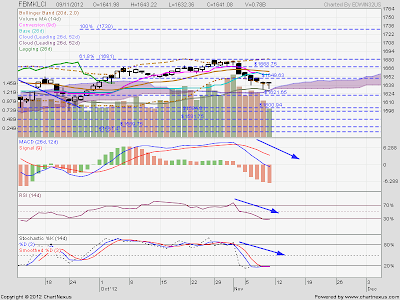

1 ) Trendline - Broke below the uptrend line .. ( Bearish )

2) Support/Resistance - Broke below the previous low ( Bearish )

2) Support/Resistance - Broke below the previous low ( Bearish )

3) MACD -Bearish Crossover with MACD 4G6R ( Bearish ) . Awaiting for 4R1G signal

4) RSI - Broken below 50% (Bearish) ,

4) RSI - Broken below 50% (Bearish) ,

5) STO - Broke below 20% and bearish crossover (Bearish)

6) Ichimoku - a) Price coming meeting from the support cloud

6) Ichimoku - a) Price coming meeting from the support cloud

b) Conversion line below the base line (Bearish).

c) Price close below the baseline ( Bearish) .

7) Candlestick pattern - Double Hammer (bullish).

c) Price close below the baseline ( Bearish) .

7) Candlestick pattern - Double Hammer (bullish).

Conclusion:

Bearish

Double hammer, this indicates a strong support and if it go up break back the resistance at 1649 we can see another bullish cycle again but if the investor ran out of bullet on tomorrow 12 November due to bearish pressure we can observe that it may test the next support at 1621

Double hammer, this indicates a strong support and if it go up break back the resistance at 1649 we can see another bullish cycle again but if the investor ran out of bullet on tomorrow 12 November due to bearish pressure we can observe that it may test the next support at 1621

Resistance- 1649 / 1668 /1681 /1725

Support - 1621 / 1600 / 1594 / 1581

Resistance- 1649 / 1668 /1681 /1725

ReplyDeleteSupport - 1621 / 1600 / 1594 / 1581

Thanks for chart. Can share how you derive the resistance at 1725?

Based on the Fibonaci Projection Method

ReplyDeleteIt looks to me like a pair of adjacent dragonflies, notice this earlier. I think it could mean an uptrend too. wait and see

ReplyDelete